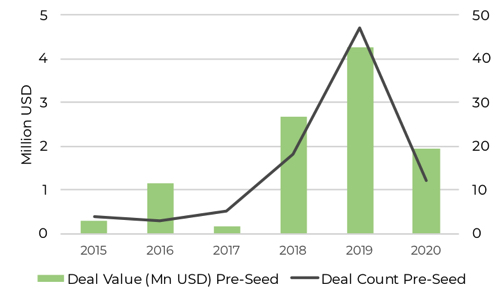

Cumulative early-stage investment (consisting of pre-seed and seed stage deals) has grown from $25.97 million USD in 2015 to $88.32 million USD in 2019 in Africa. With a total of 45.9% of all deals being secured by companies at the seed stage in 2019.

However, as a proportion of all deals closed, pre-seed investment in Africa grew from 5.73% in 2018 to 9.49% in 2019. But is this a long-term trend, and what is the impact of this increased funding for founders who are yet to have launched a fully developed product?

We look at some of the market drivers behind the figures and offer our thoughts on how we see VC investment evolving to meet the needs of early-stage ventures.