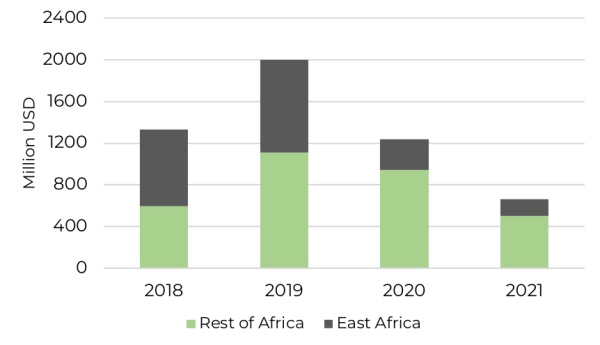

As we have reported in previous analysis, 2020 saw Venture Capital investment into African technology companies decrease considerably as a result of the coronavirus (COVID-19) pandemic. But as we enter the second quarter of 2021, have companies found a return to business as usual? Our analysts take a look at the investment figures to find out more.

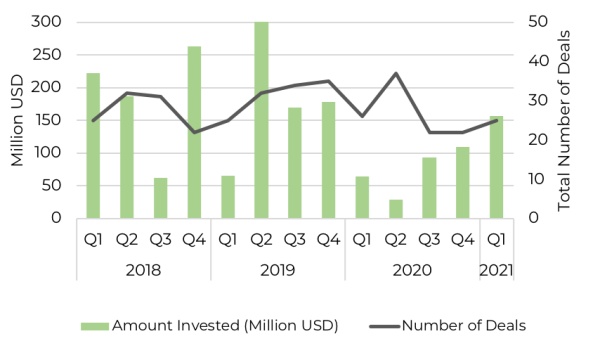

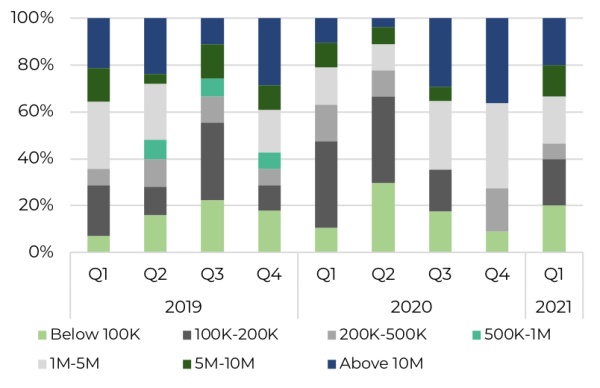

Technology investment in 2021 seems to have started the year positively. In Q1 2021, 114 venture capital raises (excluding non-equity assistance, alternative funding rounds or mergers, acquisitions) were announced across Africa, a slight decrease from the 119 investment rounds recorded in Q4 2020. While the number of reported deals is far lower than last year’s peak (137 reported in Q2 2020), investment value across Africa has increased from $217.9 million USD in Q4 2020 to $660.5 million in Q1 2021.