North Africa Start-up founders have had a busy quarter in terms of the number deals closed, but how has this translated into funding raised? Excluding grants, prizes and non-equity funding rounds, our analysts tracked a total of 24 Ventured-backed investment rounds. Although an unusually high number of these rounds were undisclosed, funding still totalled $8.71 million USD in venture investment for North African founders.

As we have seen in previous reports; the transport and logistics, and e-commerce and online retail sectors both had strong quarters across the North Africa region. The likes of Egyptian delivery company Roadrunner, Ordera and Glamera (amongst others) all securing early-stage funding rounds.

In this 13 page report, we look into the key market developments and funding rounds, as well as taking a closer look at some of the Investment Funds announced by investors across the region.

Headlines from the North Africa Start-up Report:

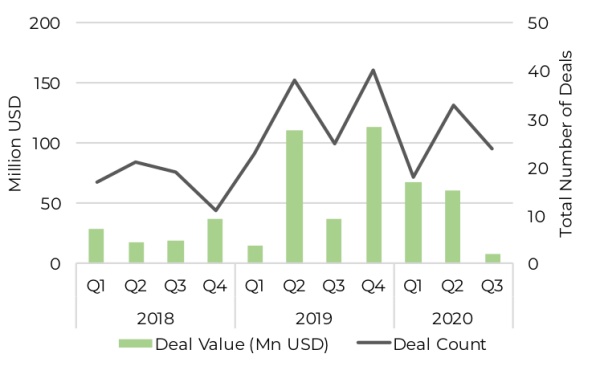

- Technology companies in North Africa secured 13% of total technology investment across Q1-Q3 2020 which is in line with the 14% secured by North African tech companies in 2019. However, Q3 investment dropped from 21.4% of total funding in H1 2020 to 2.2% in Q3 2020.

- Start-ups based in Tunisia and Morocco secured only 12.1% of funding closed by companies based in North African in 2020. This is a reduction in the proportion of funding secured by North African companies headquartered outside of Egypt; from 27.5% of total funding in 2018 and 20.5% in 2019.

- Early-stage funding, such as pre-seed, seed and Angel investment, accounted for 67% of funding in North Africa throughout both 2019 and 2020 YTD. However, the proportion of early-stage funding has risen to 76.9% in Q3 2020.