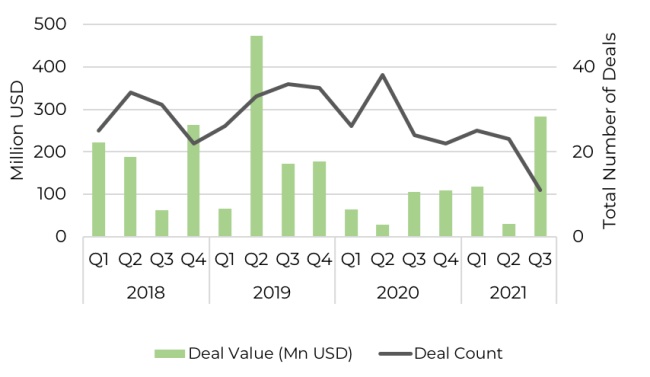

VC-funding in East Africa has already got off to a rapid start in Q3 2021. In July, US and Rwanda based healthcare logistics company Zipline announced they had closed a $250 million USD venture funding. Following this, Guidewheel (formally known as Safi) a plug and play data and analytics company for the manufacturing sector announced they had raised a $8 million USD Series A. August has seen this continue, with WapiPay, a cross-border payments company announcing a $2.2 million USD funding round which included participation from EchoVC, MSA Capital, as well as Kepple Africa Ventures.

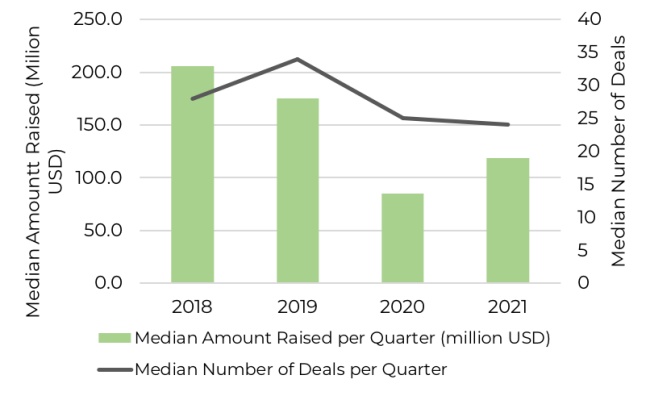

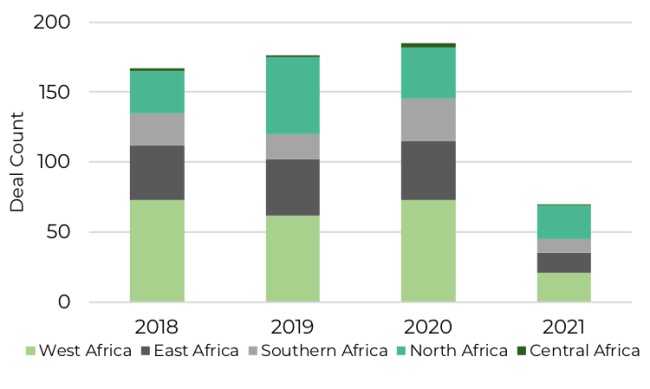

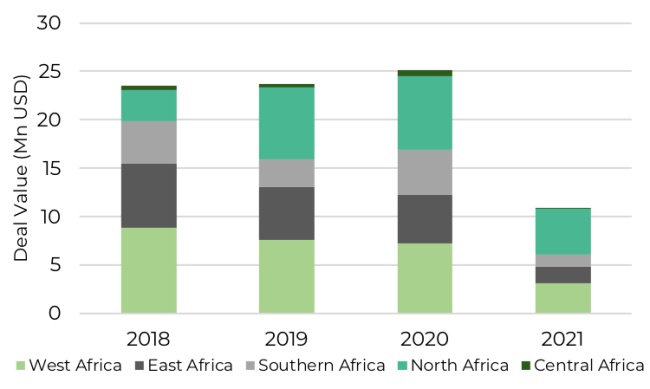

Total funding across the East Africa region in Q3 2021 has already reached a $283 million USD, bringing the total raised in 2021 to $433.2 million USD. However, while the median amount raised per quarter has increased from $84.7 million USD in 2020 to $118.6 million USD in H1 2021, the median number of deals per quarter has fallen slightly from 25 in 2020 to 24 in 2021.