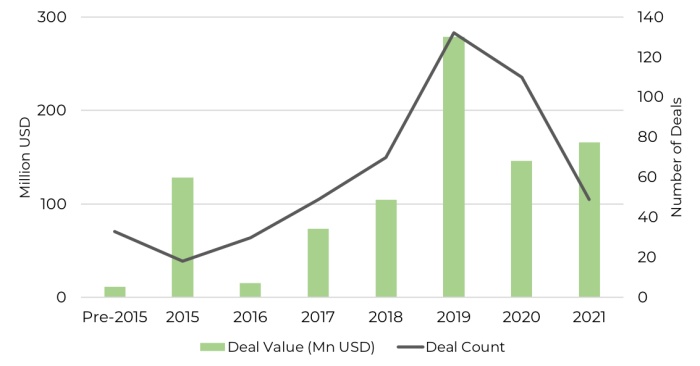

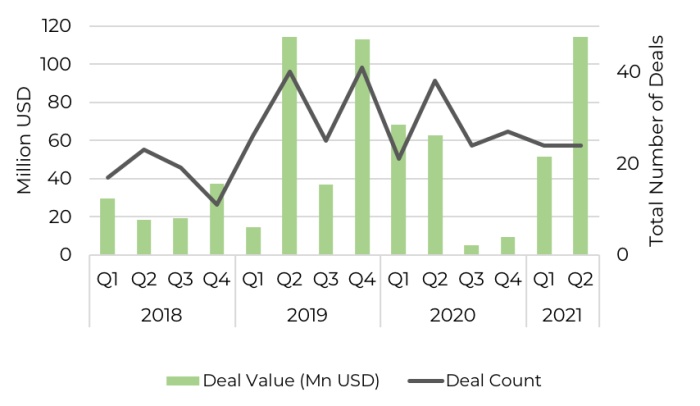

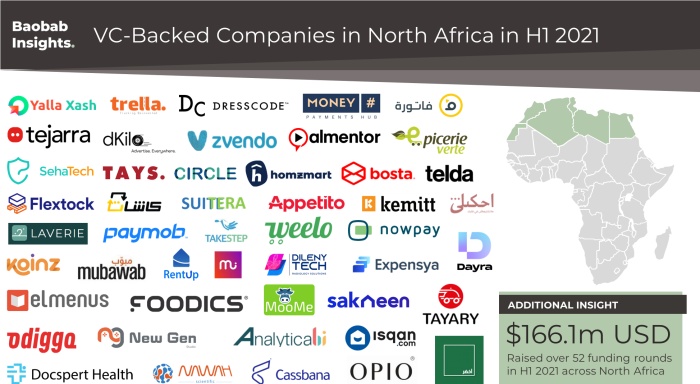

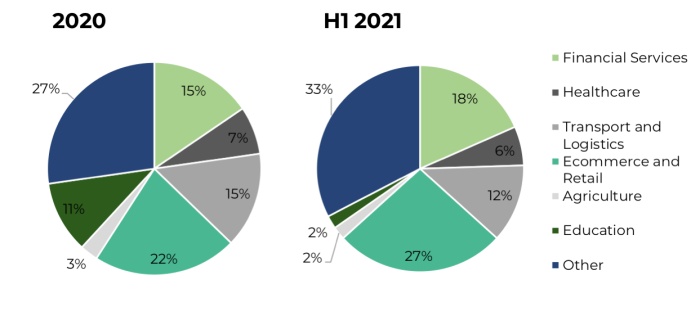

In previous reports, we have highlighted investment trends that show how start-ups operating in North Africa’s e-commerce, financial services and transport sectors are becoming a go-to for investors. At the mid-way point of the year, start-ups across North Africa have already surpassed the $145 million USD they closed in 2020.

This trend seems to show no sign of cooling off in the immediate future. Over the past month, the Dubai-based VC Nuwa Capital announced the first close of their $100 million USD fund focussing on North and East Africa. Even more recently, the National Bank of Egypt has secured a $100 million USD loan from the European Bank for Reconstruction and Development (EBRD) to support SME business across the country. So, is this recent injection of cash translating into bigger opportunities for start-ups?

A strong start to 2021

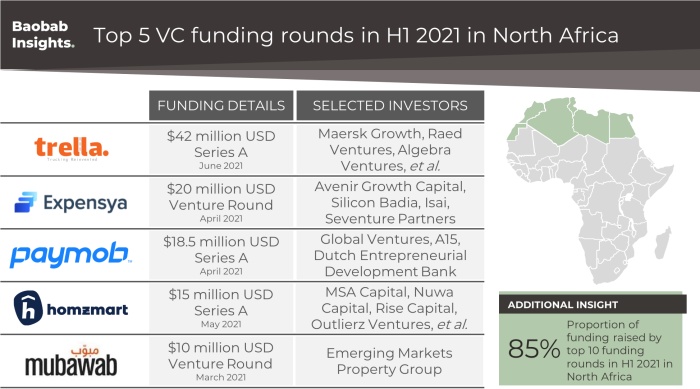

In June, Egyptian trucking and logistics company Trella secured a $42 million USD Series A to expand services into the Middle East, Pakistan, Afghanistan and North Africa. The round was led by Maersk Ventures and Raed Ventures, and is one of a number of larger later-stage rounds contributing to a strong 6 months for the North Africa region.

E-commerce companies Homzmart and Mubawab both secured funding in rounds topping $10 million. Homzmart closed a $15 million USD Series A round in May 2021, led by MSA Capital and Nuwa Capital, and Mubawab closed a $10 million USD Venture round in March, led by the Emerging Markets Property Group.

The financial services sector also saw Expensya, a provider of accounting software, secured a $20 million USD Venture round from investors including of Avenir Growth Capital and Silicon Badia. Paymob, a payments provider, secured a $18.5 million USD Series A from Global Ventures, A15 and FMO.