Market Map: 140 South Africa FinTech in 2021

News broke this week that AZA Finance (formerly known as BitPesa), a provider of treasury and FX services, acquired South Africa based cross-border payments provider Exchange4Free. Exchange4Free is the largest South African non-bank currency broker, and the acquisition enables AZA Finance to increase transaction volume to $2.5 billion in 2021 and extends the company’s reach to 115 countries spanning Africa, Europe, the Middle East, Asia-Pacific and North America. The move makes AZA Finance the largest fintech provider of treasury and FX services to frontier markets.

In a company press release regarding the acquisition, AZA Finance cites changing customer dynamics in response to the coronavirus (COVID-19) pandemic as being a driver towards increased volumes of business transactions moving online and away from physical bank branch infrastructure. Technology companies in Africa (where SMEs have faced expensive and time-consuming banking processes) are leading the challenge against established dollar-based systems through the use of APIs and other network technologies.

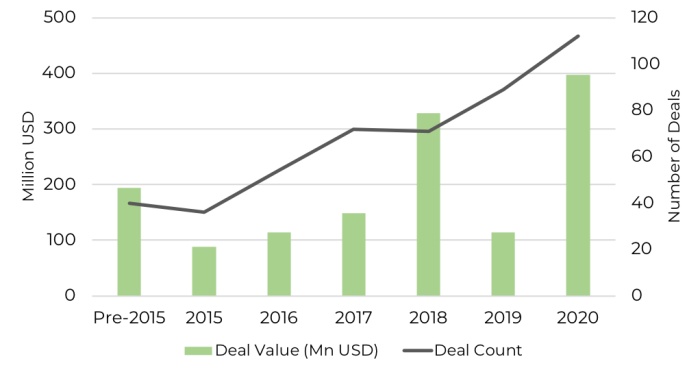

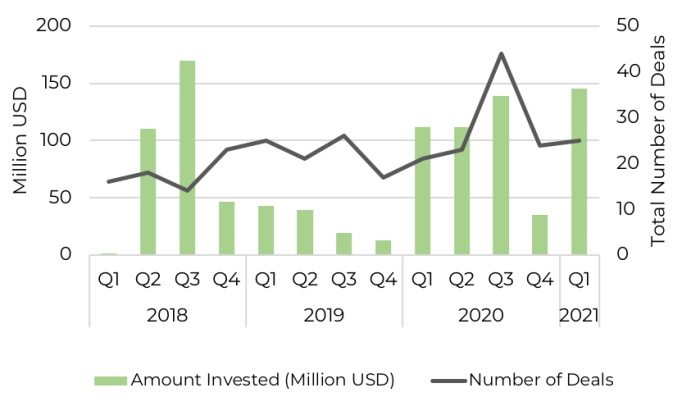

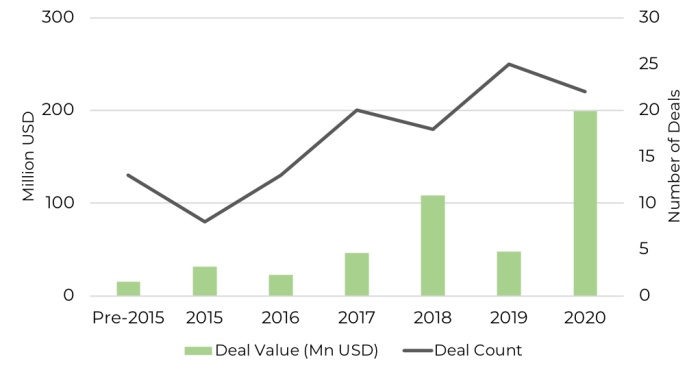

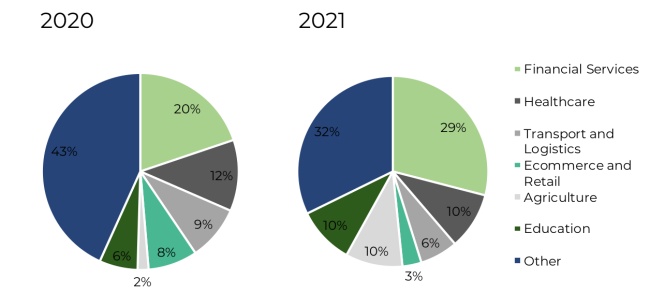

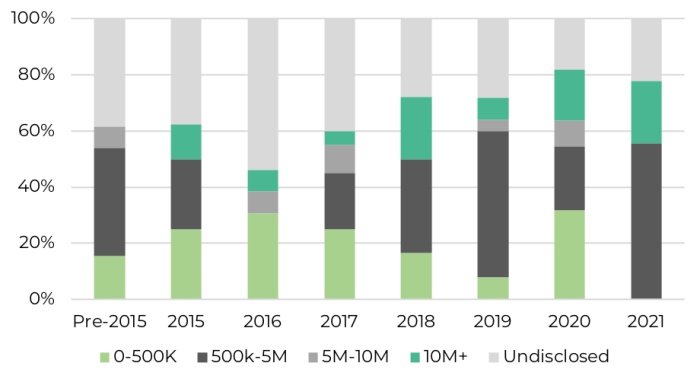

We took a closer look to understand how VC investment has responded to this change across the Southern Africa region.