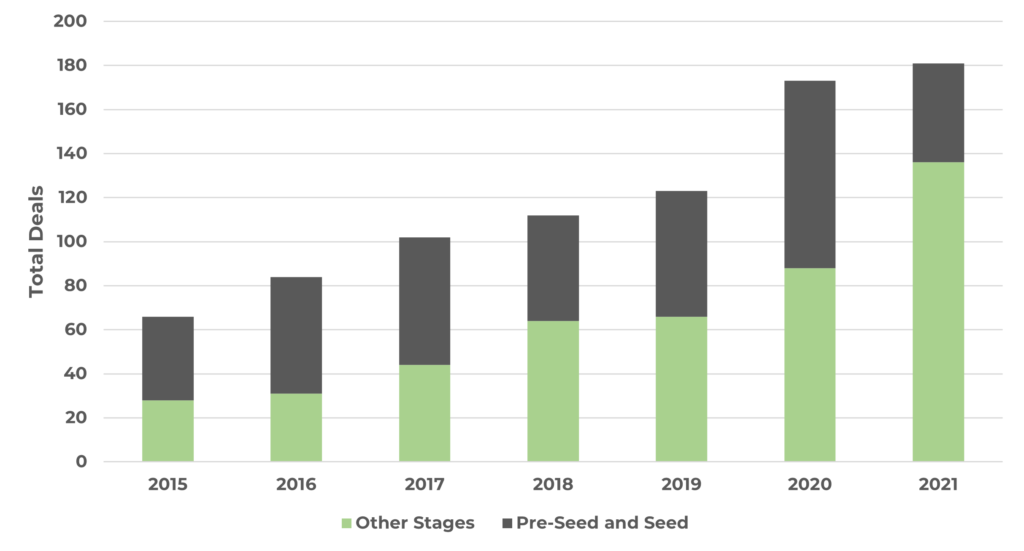

The Southern Africa Venture Capital and Private Equity Association (SAVCA) gathers data and publishes reports on the regional venture capital landscape. In their 2020 report, published earlier this year, we saw that despite the crisis brought by the global pandemic, South African tech start-ups received more deals and increased funding.

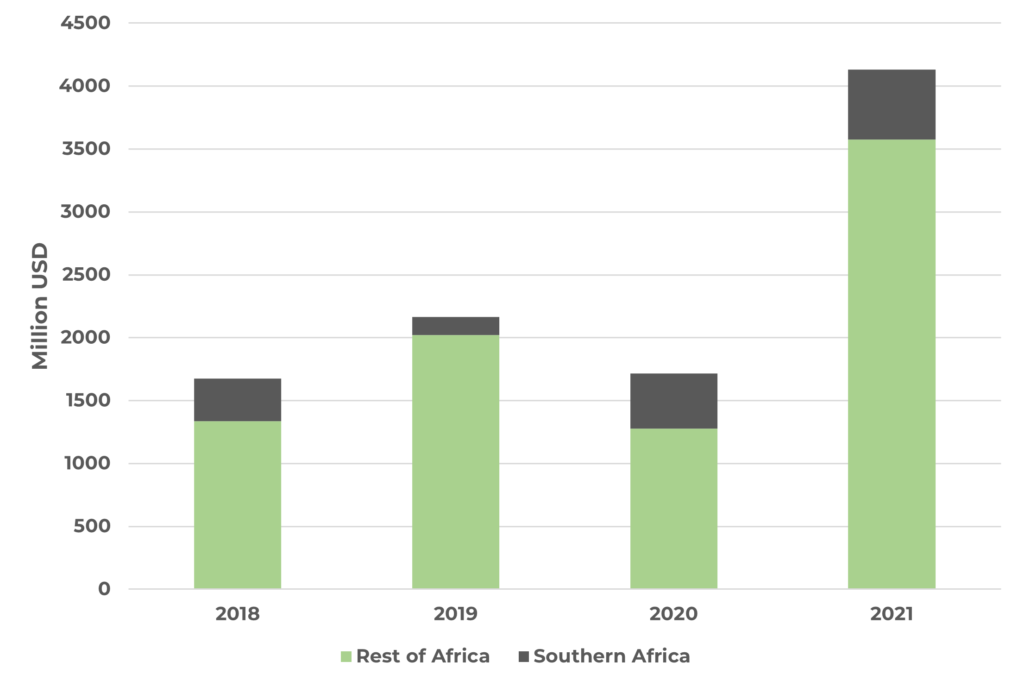

Southern African VC investment grows.

There has been a rise in the funding going towards Southern African technology companies this year. Total funding in 2021 beats that of the previous 2 years, with $452.1 million USD and $149.8 million USD (excluding grants, prizes and other non-equity deals) secured in 2020 and 2019 respectively by Southern African technology companies.