VC-Backed Transport and Logistics in Africa

Over the past few years, we have seen a definite shift in how people move things and around. In the wake of the fourth industrial revolution, digitization has made its way into the transport and logistics sector as African start-ups provide solutions for moving goods and people.

The past year was a mixed bag for transport and logistics companies; faced with Covid-19 restrictions, some start-ups faced major hurdles, in Kampala for instance, where motorcycle taxis were banned to curb the spread of the virus. Other transport and logistics companies, such as delivery platforms, thrived during the same period as people turned to delivery apps to get food and other goods to their homes.

Launching at the beginning of this year, the African Continental Free Trade Agreement (AfCFTA) seeks to remove restrictions on travel and trade for Africans, making efficient transport and logistics across the continent increasingly important.

How are African transport and logistics companies rising to the challenge?

In August 2021, Alerzo, a transport and logistics company digitising the distribution process for traditional traders and SMEs in Nigeria secured $10.5 million USD in a Series A funding round. In North Africa, MaxAb, a B2B food and grocery delivery start-up also announced an additional $15 million USD to their Series A funding round closing at over $60 million USD as they acquired WaystoCap, a Moroccan counterpart, to expand their regional coverage.

We have also seen the Cairo-based mobility start-up, Swvl, on the cusp of unicorn status after partnering with a SPAC, female-led Queen’s Gambit Growth Capital in a bid to go public on the NASDAQ.

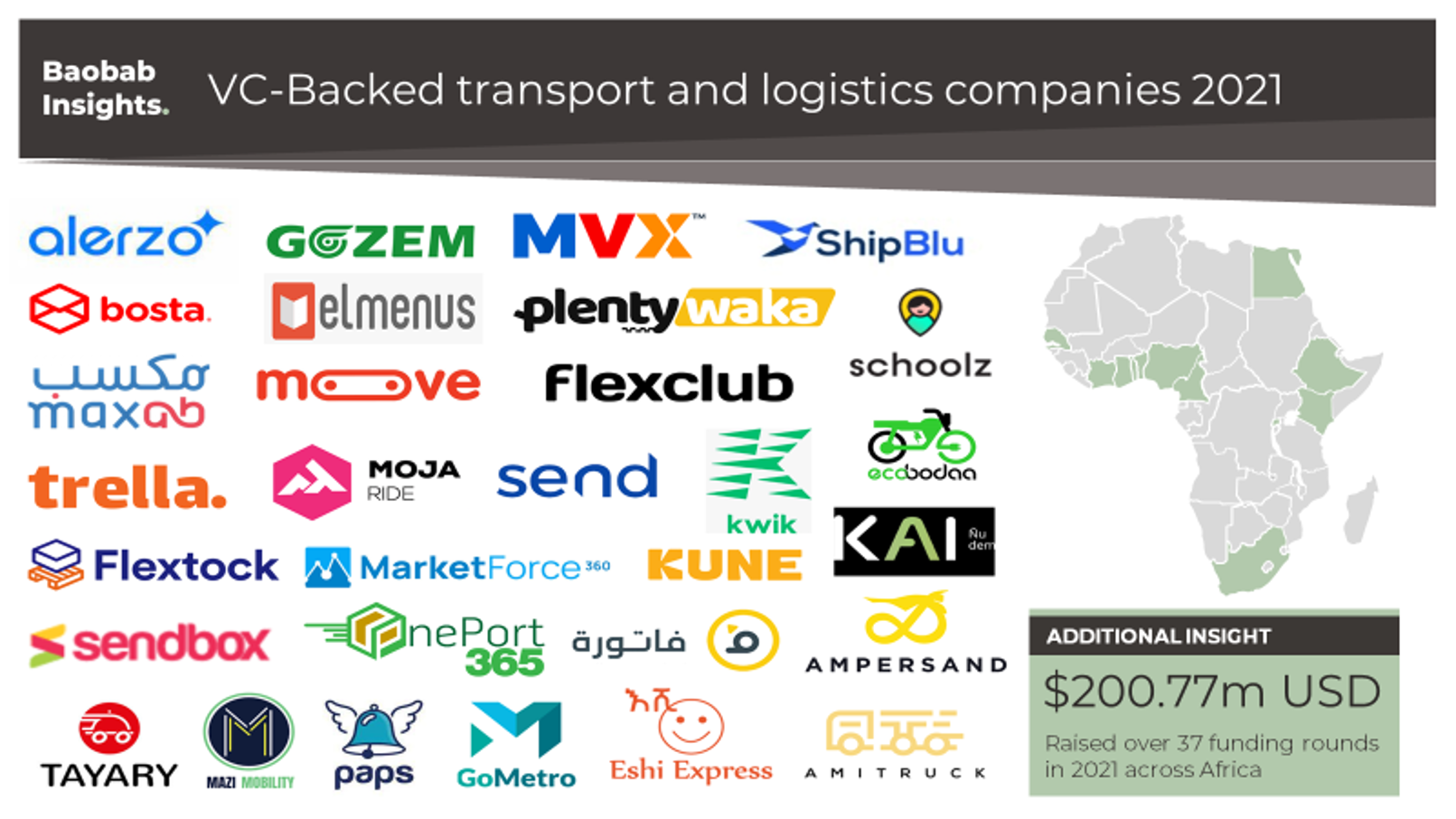

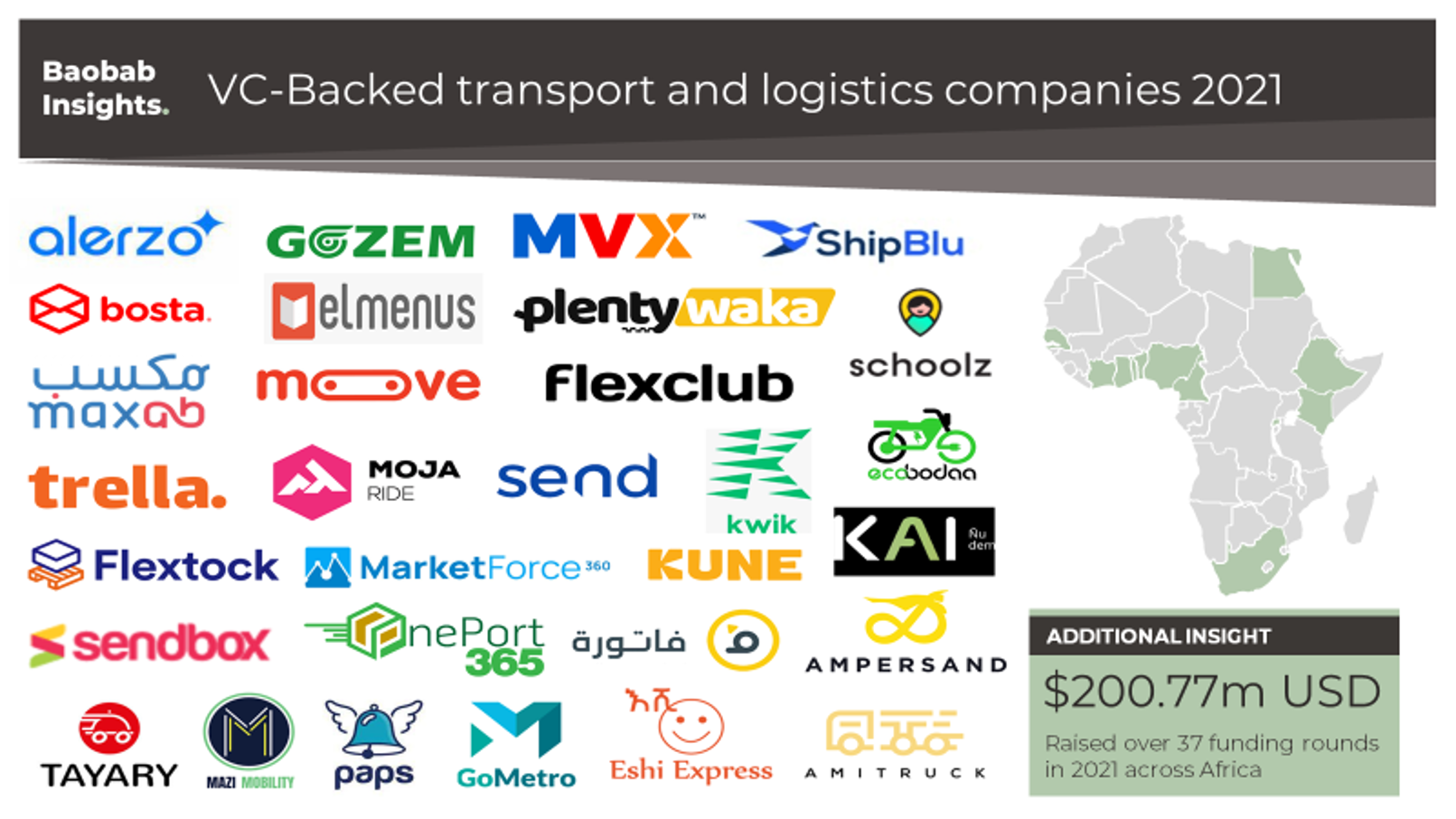

Our research team found over 430 African transport and logistics start-ups in Africa in our database and of these, 65% were founded during or after 2017. This year, 30 transport and logistic companies have secured VC Funding over 37 funding rounds (excluding grants, non-equity fundraises, crowdfunding and corporate rounds).

Fig. 1: Market Map: VC-Funded Transport and Logistics start-ups in 2021

In Africa, the transport and logistics sector spans to cover B2B distribution and e-commerce platforms like Alerzo and MaxAB, to school mobility solution, Schoolz, to food delivery and cloud kitchen, Kune, and even green transport solutions like Ecobodaa and Ampersand. This year, transport and logistics companies in Africa have secured $200.77 million USD over 37 funding rounds.

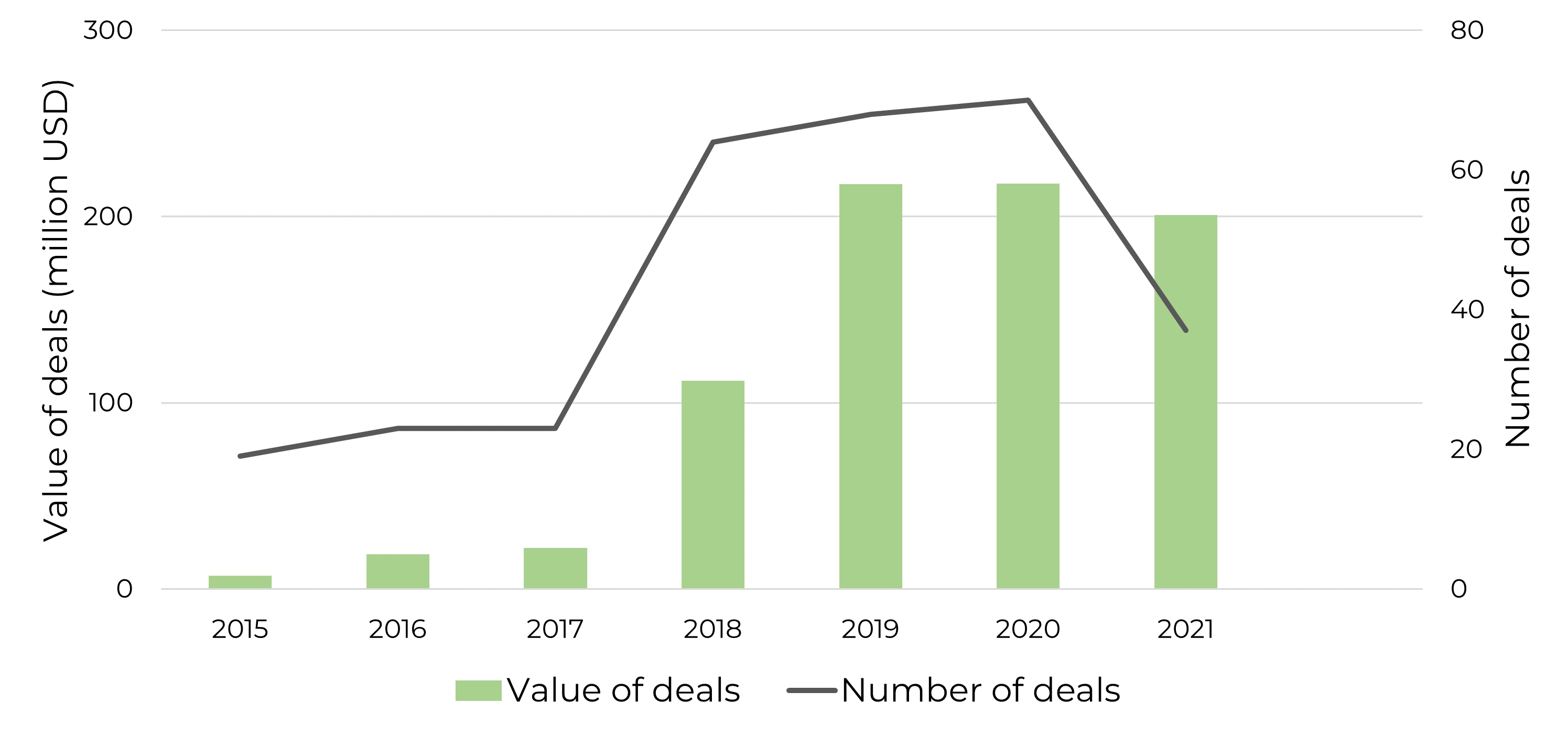

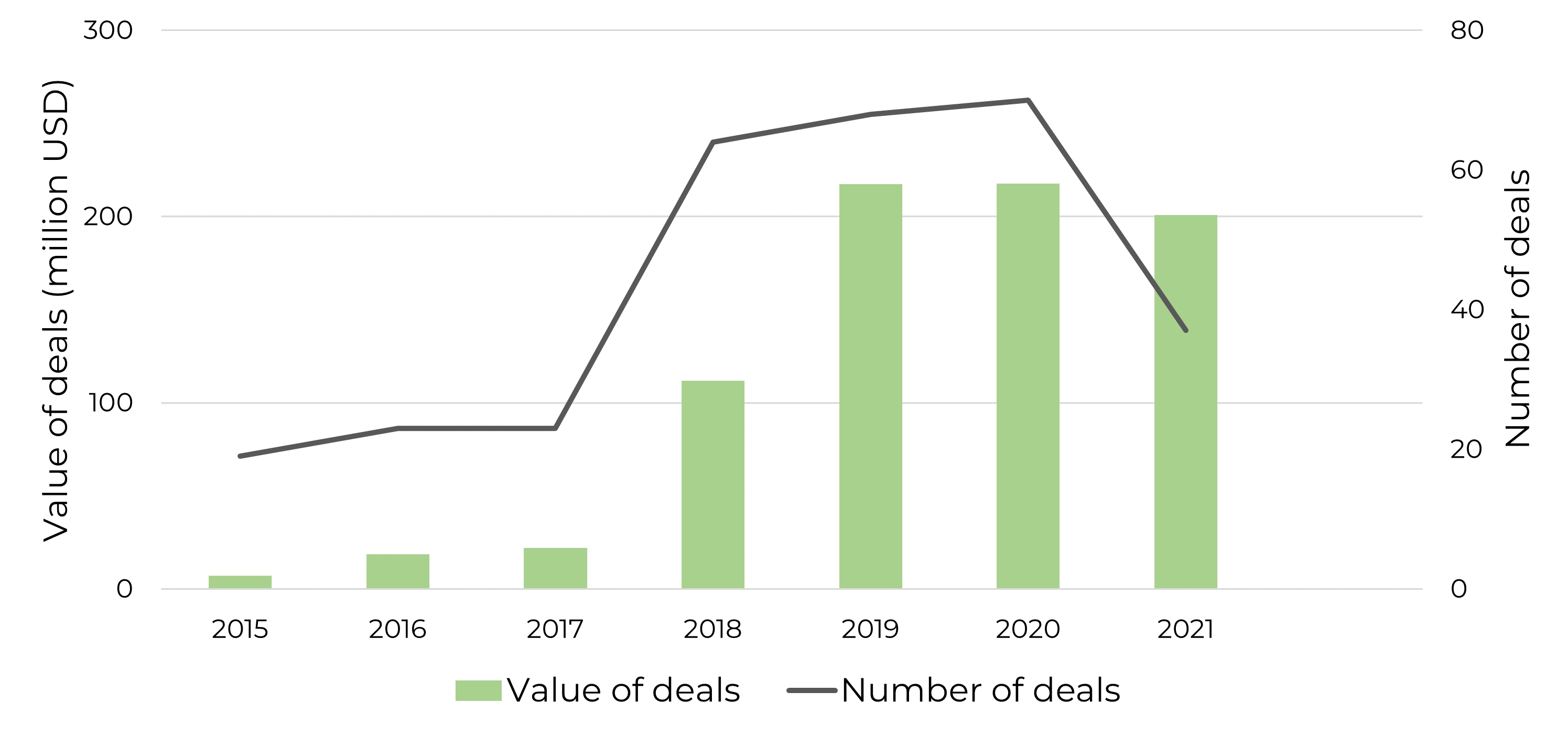

Fig. 2: Total investment in transport and logistics companies in Africa since 2015

As seen in figure 1 above, funding in technology-enabled transport and logistics start-ups in Africa has increased significantly since 2015, with a total of $200.7 million USD being invested in 2021 to date (September 5th 2021). Total annual funding in this sector has jumped over 2800% since 2015.This year, we have already seen big raises with exclusive Uber partner and mobility financer, Moove, securing $40 million USD in a debt financing round in May and $23.2 million USD in a Series A funding round in August.

Egyptian and Nigerian transport and logistics companies tied for the most deals, with 11 rounds each in 2021so far. The Egyptian start-ups raised $108 million USD while Nigerian start-ups have garnered $178 million USD. West African transport and logistics start-ups accounted for the most funding rounds across Africa, with 43% going to the region.

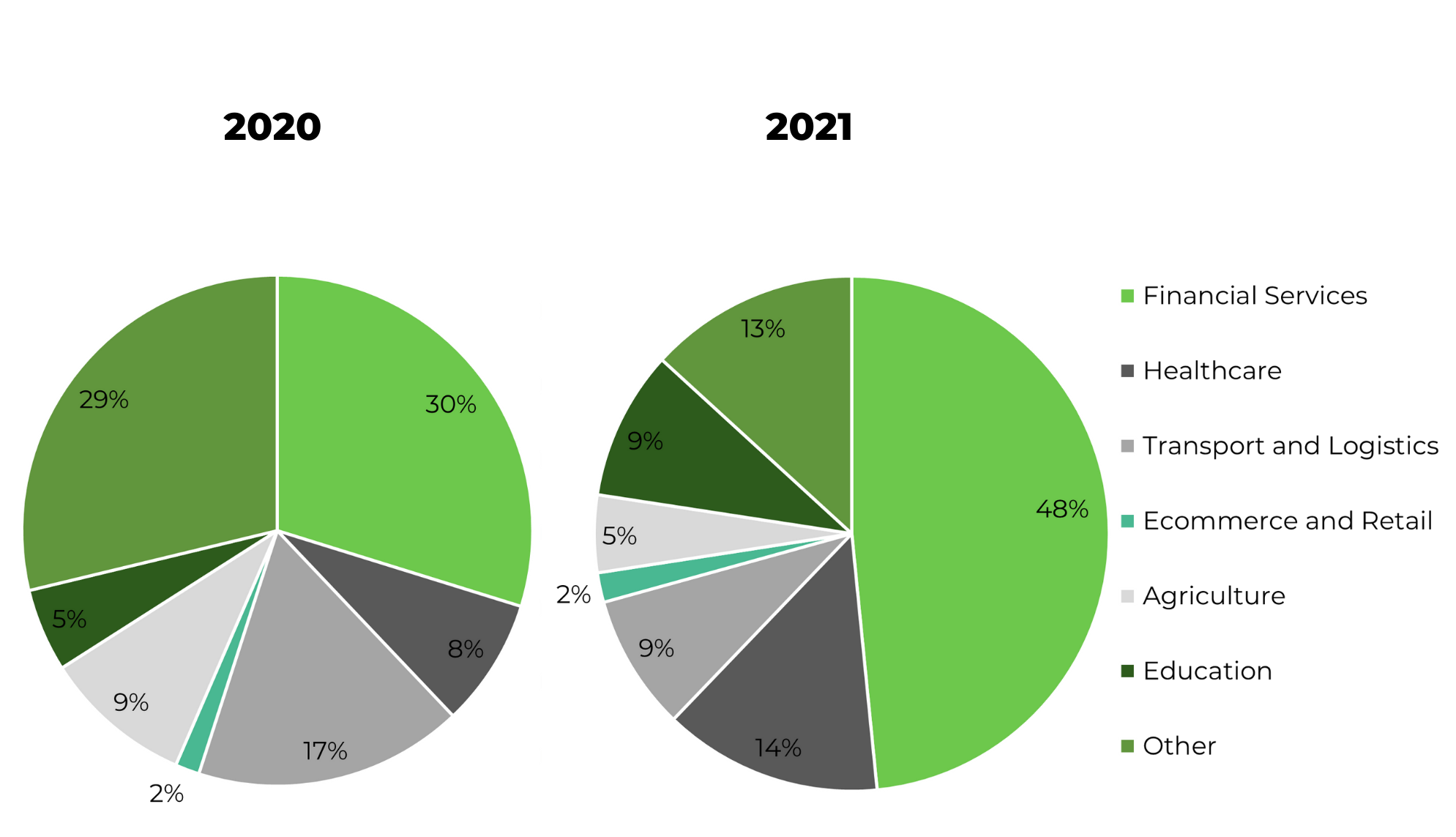

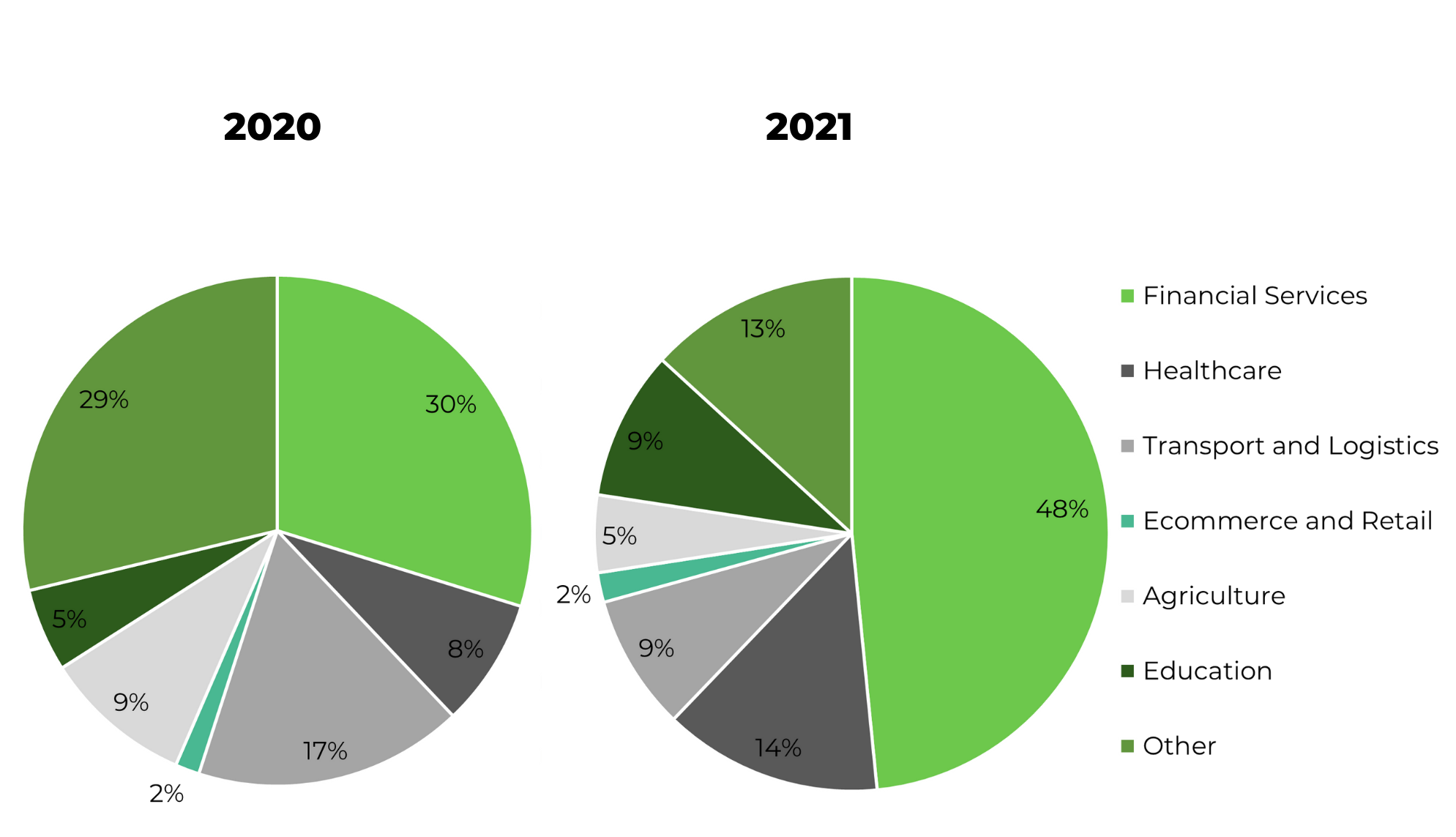

Fig. 3: Proportion of funding amount by sector

Over the past 2 years, FinTech start-ups have attracted the lion’s share of investment with 30% and 48% in 2020 and 2021 respectively. Comparatively, transport and logistics start-ups have had a dip the amount of funding raised over the period going from 17% in 2020 to 9% in 2021. Transport and logistics companies are still on track for their best year yet in terms of value raised however, as last years’ $217 million USD total was the top performance for the sector, and 92% of that has been achieved in 8 months.

How are early-stage start-ups faring in 2021?

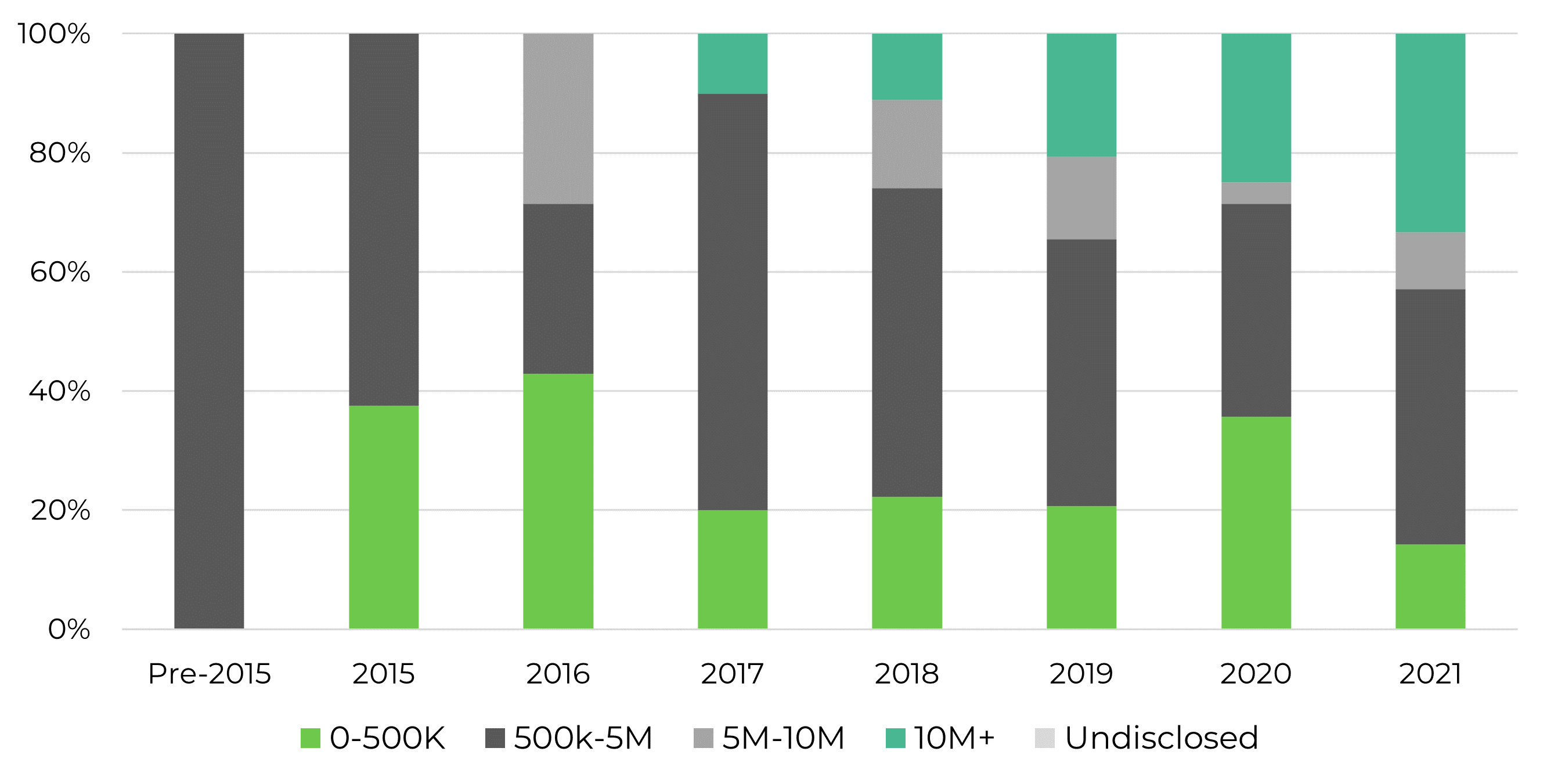

Of the 37 funding rounds in 2021 so far, 62% were either seed or pre-seed funding rounds, with values ranging from $50,000 USD secured by Gozem and Send Technologies in seed funding rounds to $3.25 million USD raised by Egypt’s Flextock in a pre-seed funding round.

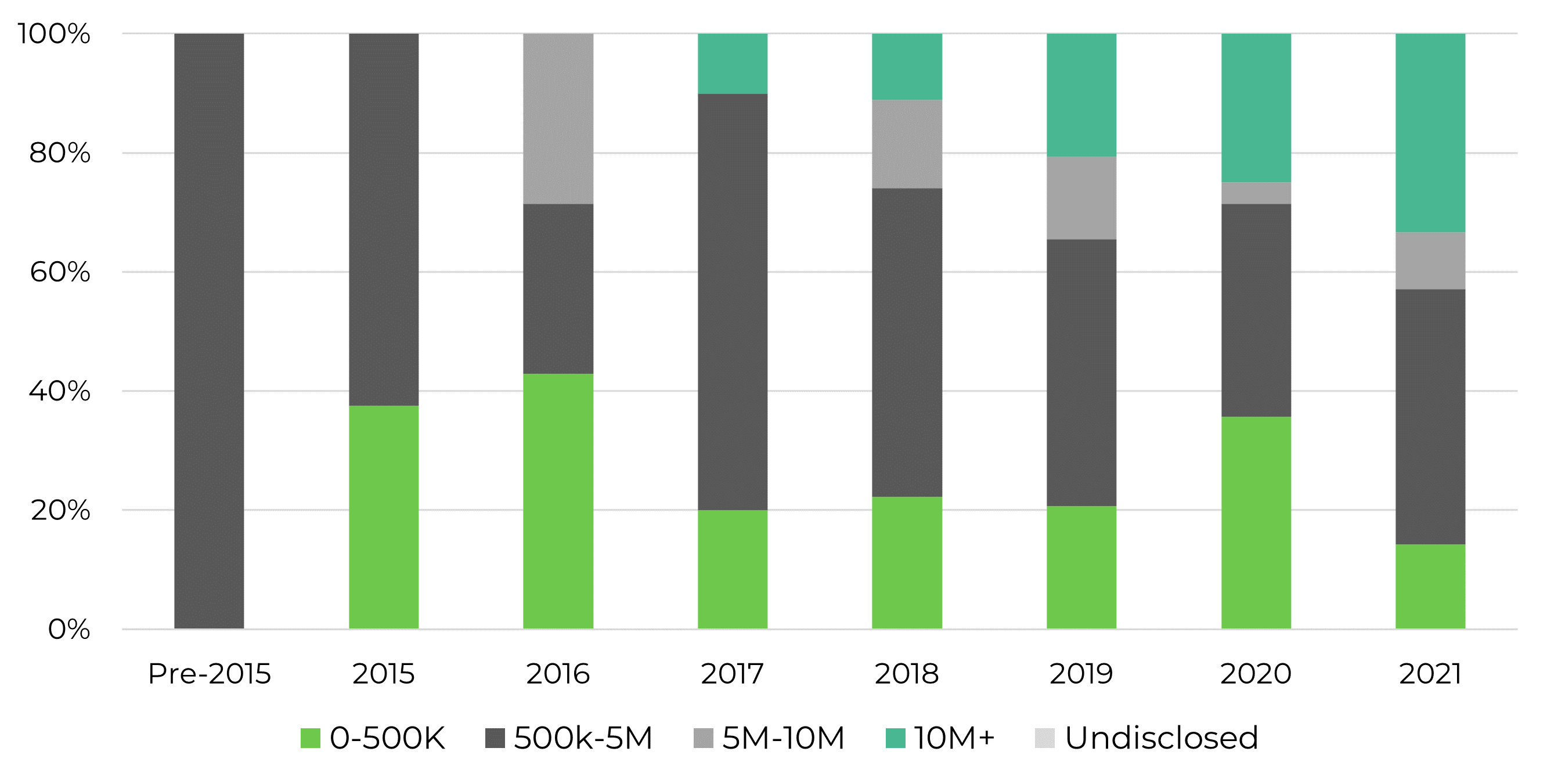

Fig. 4: Breakdown of funding into transport and logistic companies by investment range

Sub-$500,000 USD tickets have dipped this year as transport and logistic companies across Africa grow and gain the attention of investors. We see investments in the 10M+ range have greatly increased this year, accounting for almost 30% of the investments.

It has already been a record year for transport and logistics companies in Africa, with 4 months left to go in 2021. Will funding continue to flow in as the year wraps?

VC-Backed Transport and Logistics in Africa

Over the past few years, we have seen a definite shift in how people move things and around. In the wake of the fourth industrial revolution, digitization has made its way into the transport and logistics sector as African start-ups provide solutions for moving goods and people.

The past year was a mixed bag for transport and logistics companies; faced with Covid-19 restrictions, some start-ups faced major hurdles, in Kampala for instance, where motorcycle taxis were banned to curb the spread of the virus. Other transport and logistics companies, such as delivery platforms, thrived during the same period as people turned to delivery apps to get food and other goods to their homes.

Launching at the beginning of this year, the African Continental Free Trade Agreement (AfCFTA) seeks to remove restrictions on travel and trade for Africans, making efficient transport and logistics across the continent increasingly important.

How are African transport and logistics companies rising to the challenge?

In August 2021, Alerzo, a transport and logistics company digitising the distribution process for traditional traders and SMEs in Nigeria secured $10.5 million USD in a Series A funding round. In North Africa, MaxAb, a B2B food and grocery delivery start-up also announced an additional $15 million USD to their Series A funding round closing at over $60 million USD as they acquired WaystoCap, a Moroccan counterpart, to expand their regional coverage.

We have also seen the Cairo-based mobility start-up, Swvl, on the cusp of unicorn status after partnering with a SPAC, female-led Queen’s Gambit Growth Capital in a bid to go public on the NASDAQ.

Our research team found over 430 African transport and logistics start-ups in Africa in our database and of these, 65% were founded during or after 2017. This year, 30 transport and logistic companies have secured VC Funding over 37 funding rounds (excluding grants, non-equity fundraises, crowdfunding and corporate rounds).

Fig. 1: Market Map: VC-Funded Transport and Logistics start-ups in 2021

In Africa, the transport and logistics sector spans to cover B2B distribution and e-commerce platforms like Alerzo and MaxAB, to school mobility solution, Schoolz, to food delivery and cloud kitchen, Kune, and even green transport solutions like Ecobodaa and Ampersand. This year, transport and logistics companies in Africa have secured $200.77 million USD over 37 funding rounds.

Fig. 2: Total investment in transport and logistics companies in Africa since 2015

As seen in figure 1 above, funding in technology-enabled transport and logistics start-ups in Africa has increased significantly since 2015, with a total of $200.7 million USD being invested in 2021 to date (September 5th 2021). Total annual funding in this sector has jumped over 2800% since 2015.This year, we have already seen big raises with exclusive Uber partner and mobility financer, Moove, securing $40 million USD in a debt financing round in May and $23.2 million USD in a Series A funding round in August.

Egyptian and Nigerian transport and logistics companies tied for the most deals, with 11 rounds each in 2021so far. The Egyptian start-ups raised $108 million USD while Nigerian start-ups have garnered $178 million USD. West African transport and logistics start-ups accounted for the most funding rounds across Africa, with 43% going to the region.

Fig. 3: Proportion of funding amount by sector

Over the past 2 years, FinTech start-ups have attracted the lion’s share of investment with 30% and 48% in 2020 and 2021 respectively. Comparatively, transport and logistics start-ups have had a dip the amount of funding raised over the period going from 17% in 2020 to 9% in 2021. Transport and logistics companies are still on track for their best year yet in terms of value raised however, as last years’ $217 million USD total was the top performance for the sector, and 92% of that has been achieved in 8 months.

How are early-stage start-ups faring in 2021?

Of the 37 funding rounds in 2021 so far, 62% were either seed or pre-seed funding rounds, with values ranging from $50,000 USD secured by Gozem and Send Technologies in seed funding rounds to $3.25 million USD raised by Egypt’s Flextock in a pre-seed funding round.

Fig. 4: Breakdown of funding into transport and logistic companies by investment range

Sub-$500,000 USD tickets have dipped this year as transport and logistic companies across Africa grow and gain the attention of investors. We see investments in the 10M+ range have greatly increased this year, accounting for almost 30% of the investments.

It has already been a record year for transport and logistics companies in Africa, with 4 months left to go in 2021. Will funding continue to flow in as the year wraps?