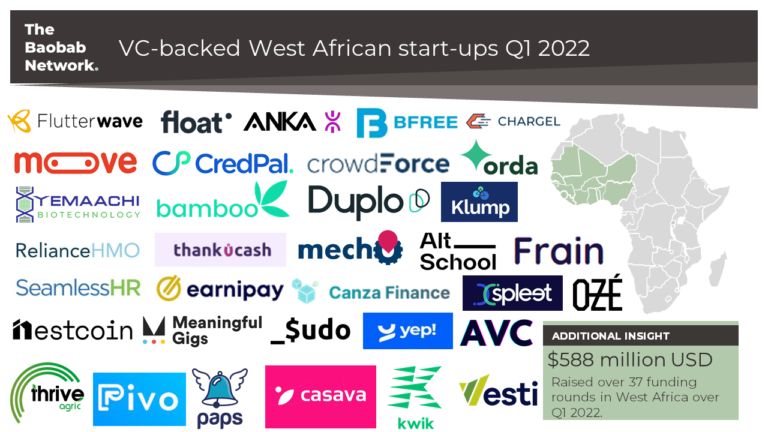

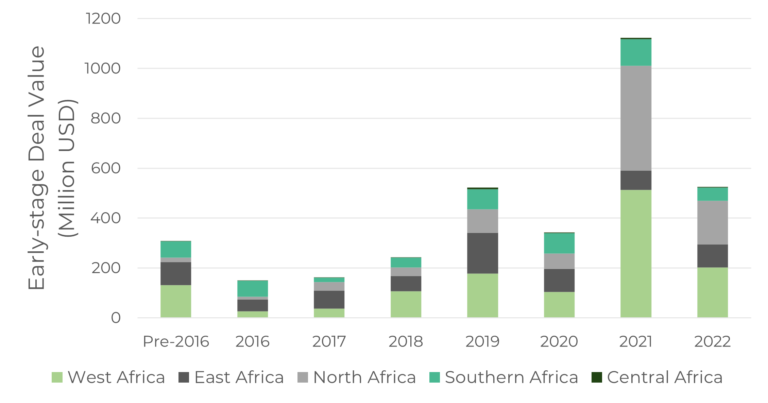

In this report, we break down the funding in West Africa in Q1 2022, how has Africa’s most populated region fared over the first 2 months of 2022 in terms of VC-backing ad investment going towards local technology start-ups?

In April 2022, Microsoft announced plans to support 10,000 African start-ups over the next five years through partnerships with accelerator and incubator programmes, as well as VCs to potentially provide over $500 million in funding.

This is not the only giant name from Silicon Valley to invest in African technology companies. Last year, Google launched a $50 million USD fund to support early- and growth-stage start-ups in Africa.