Over the past month, 2 new African unicorns were made, bringing the current total to 6 (depending on who you ask). Both the new-made unicorns were FinTechs; first came OPay, the Nigerian mobile wallet and money transfer service which was valued at $2 billion USD following a $400 million Series C funding round. Shortly after that announcement came the Wave Series A funding round which broke records as the biggest Series A funding round secured at $200 million USD, and the first Francophone Africa unicorn, with the Senegal-based payment services company now being valued at $1.7 billion USD.

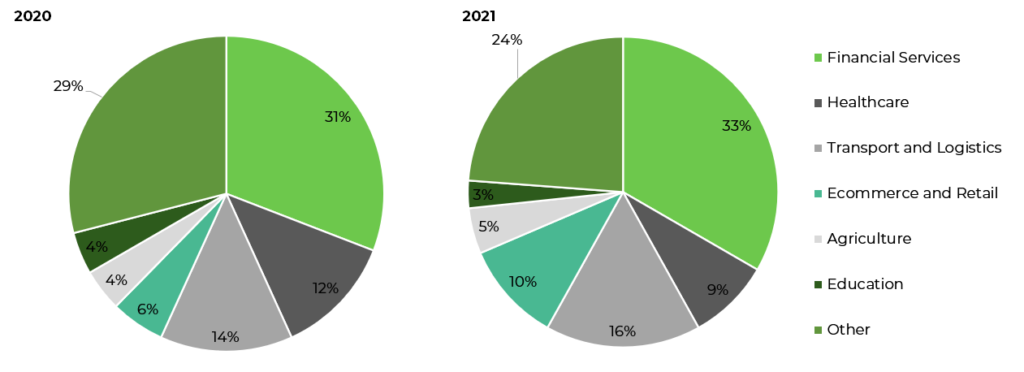

Of the rest of the African unicorns, all are in the financial service sector, apart from e-commerce and retail company, Jumia. Interestingly, all are headquartered in West Africa, except for Egypt’s Fawry. We decided to take a look at the West African FinTech landscape this year and examine the impact of VC investment on the sector.

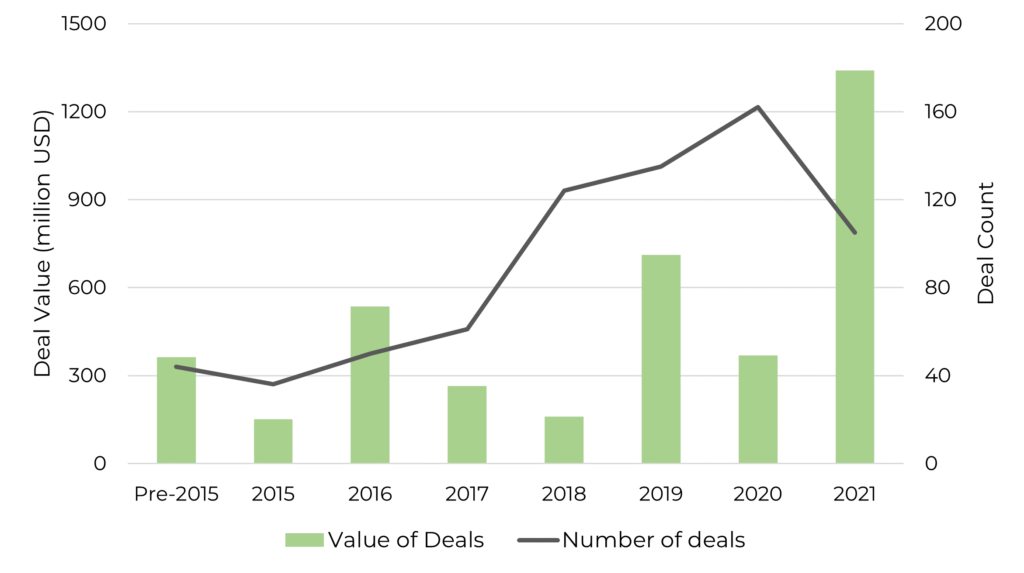

West African VC investment on the up