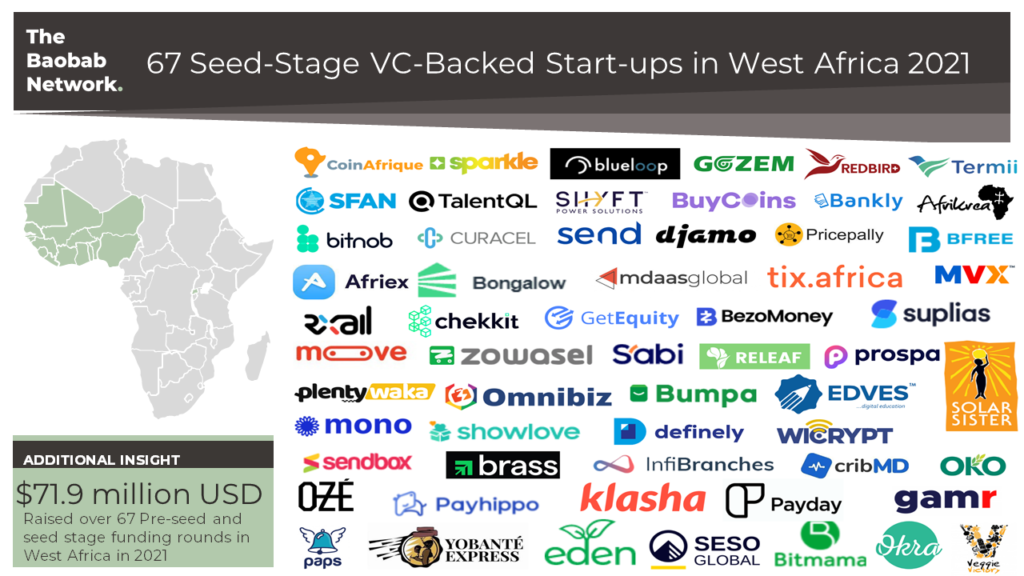

In the first half of this year, we reported that VC activity in West Africa was off to a great start, and 6 months in, the value of deals had surpassed the 2020 total and was on track to beat the year prior with 92% of the 2019 total already raised by August 2021.

It has certainly been a big year for West African start-ups at all stages. One of our portfolio companies, Nigeria-based logistics start-up Alerzo, secured a $10.5 million USD Series A and acquired another of our portfolio companies, a Nigerian payments platform, Shago.

The West African region has also produced 3 new billion-dollar valued companies this year. Senegal-based Wave and two Nigeria-based companies, Andela and Flutterwave.

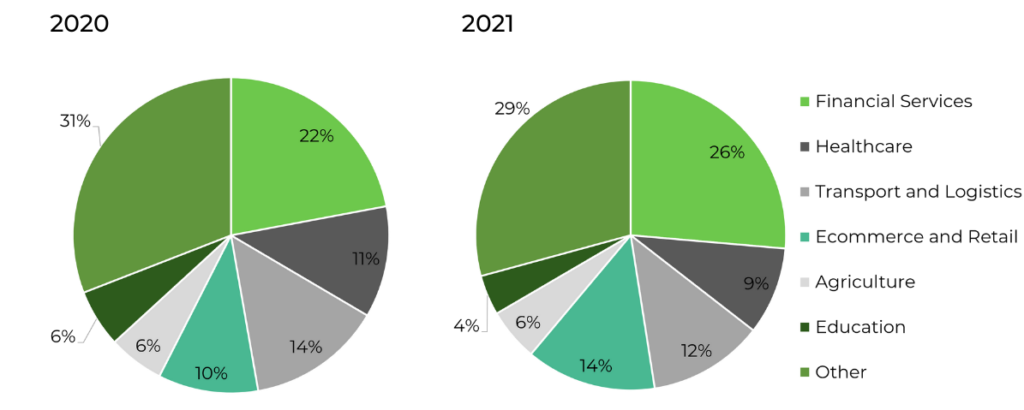

West Africa VC investment is booming

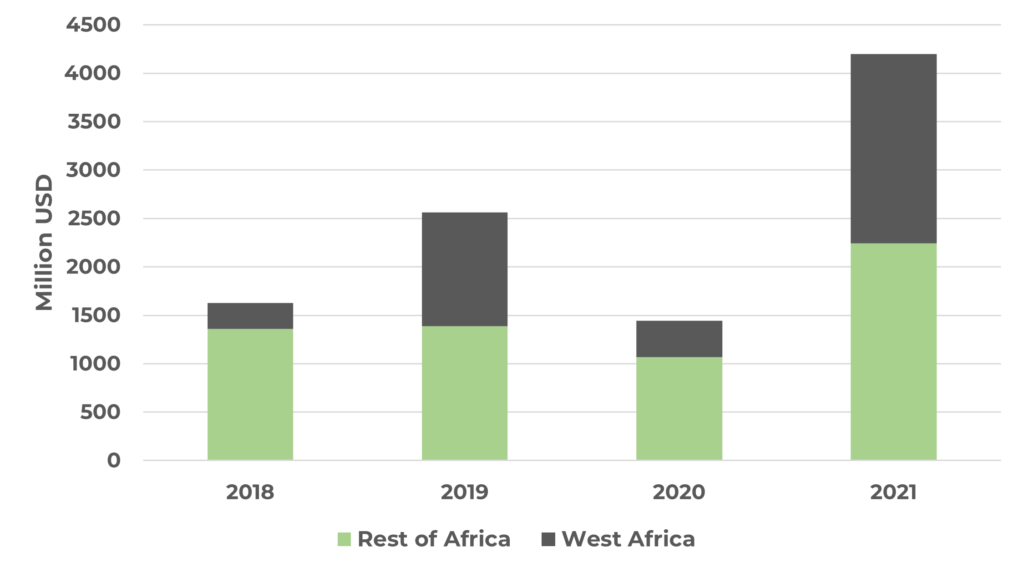

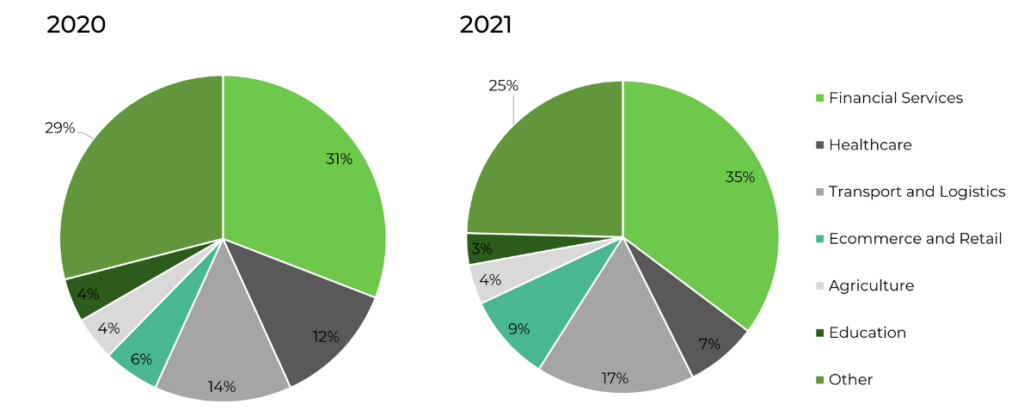

In 2021, West African technology companies secured $1.4 billion USD (excluding grants, prizes, and non-equity fundraises) over 122 funding rounds. This amounts to 45.5% of the total investment into African technology companies which currently stands at $3.08 billion USD over 383 funding rounds.

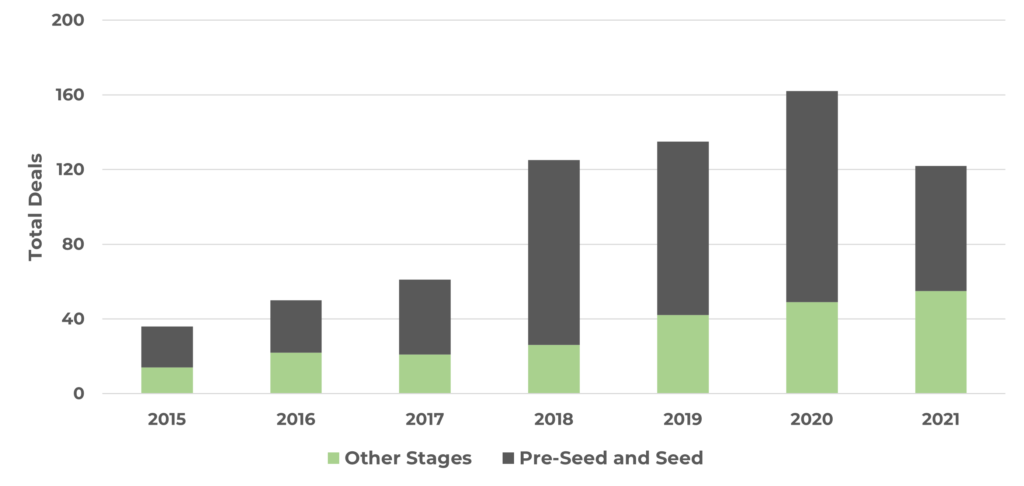

As we shared in an earlier report, VC funding in 2020 slumped slightly due to the Covid-19 pandemic totalling $1.44 billion USD over 682 funding rounds versus $2.56 billion USD secured in 2019 over 610 funding rounds.